|

Any investor who buys property abroad is interested in reliable tenants and a long-term relationship with them. In this case, an essential parameter of the object is the type of existing lease agreement, which determines the number of expenses that fall on the tenant's shoulders.

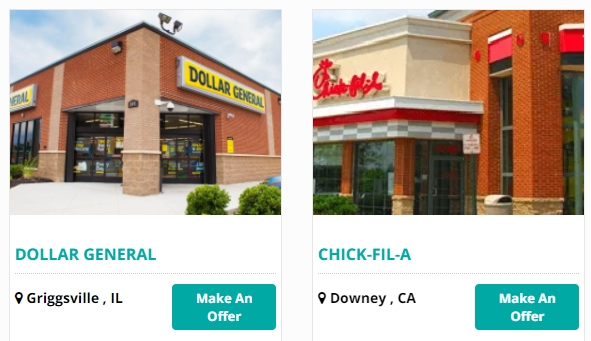

NNN Properties for sale

| In contrast to the gross Lease, Net Rental is a preferable option for the investor when the landlord takes care of most operating costs. Let's focus on this type and its varieties. The Net Lease agreement is most common in the industrial property markets. The purchase of the property, already in the lease, gives an investor many advantages over purchasing a house. These advantages include:

- 1. A long-term relationship. The renter has already chosen in favor of a particular property and intends to use it for many years. The investor receives the property and an established relationship with the renter(s).

- 2. Stable income with minimum worries. The investor knows the level of profitability of the objectives and the amount of regular financial income in advance. In this case, all unforeseen costs, such as repairs or increased tax rates, fall on shoulders.

- 3. Freedom of movement. The owner does not need to be in the same town with the object — the tenant is responsible for its maintenance.

- The ability to attract co-investors. Property, which already has a tenant, can be purchased by several investors.

The term Triple-Net appeared on the warehouse real estate market so long ago. It is widespread in the field of property. The term is the antonym of gross when the owner takes a substantial part of operating costs. Triple-Net pays for everything, while the investor can assess the net profit of the property.As mentioned above, with a gross lease, some of the OPEX falls on the owner's shoulders - and it's not beneficial to him. The Net Rental option implies that it not only pays the contractual rate but is also responsible for maintaining the facility.

The level of the rent is usually lower. But the investor's goal — not the immediate attraction of profits and a long-term contract. Therefore, an investor who will invest in the project wants to see the financial side of the transaction transparent and clear. It helps him assess the profitability and risks — if the stakes are high, you can abandon the deal.

If the logistics complex is leased under the scheme of three N, the investor's risks are significantly reduced. After all, even with an increase in taxes and OPEX, the renter will pay them. And therefore, the lion's share of the risks lies with him.

Triple net lease for sale provides stability and long-term income — this is the main advantage of the property. A common question that home buyers ask about investing in a net lease property is, "What are the benefits of investing in a net lease property?" A net lease is a rental arrangement in which the lessee, also called the owner, leases the property to the individual who intends to live in it. The net lease typically has periodic payments that equal the monthly rents for the period of the lease. This means that the individual who signs the agreement must pay rent for the term of the agreement. This type of arrangement can be an attractive option for investors. In this article, we will discuss the benefits of investing in net lease properties for sale. Investors interested in net lease properties for sale should be aware that they may need to consider some financial planning before signing the agreement. First and foremost, it is important to remember that net lease contracts typically have periodic fees and expenses associated with them. These costs will usually depend on the specific lease agreement that was negotiated. Still, it is always a good idea to consult a knowledgeable attorney or real estate professional before agreeing to lease a net lease property. It is also important to remember that these fees and expenses do not need to be paid when signing the contract. Instead, they can accrue during the length of the lease agreement. When investors sign a lease agreement, they often receive a letter of responsibility that clearly outlines all expenses incurred during the term of the agreement. In most cases, the document also spells out when these expenses must be paid. Some leases specify that homeowners must pay a certain amount of money toward property taxes every year. Many investors interested in net lease properties for sale will want to be sure that they understand what these fees are and whether or not they will need to be paid. Another benefit of investing in such an agreement is that many investors find that they can negotiate better terms than they would if they were to open up their bank account and take out a loan. There are many legal aspects involved with signing a lease agreement, including several complicated tax issues. In some cases, the leaseholder ( purchaser ) may be responsible for paying taxes on the property. For this reason, many investors prefer to have a third party handle these matters. By placing all of these obligations in the hands of a third party, many investors find that they can get better deals, even if the terms of the lease agreements are slightly different. Net lease agreements are not immune from pitfalls. One common problem for investors is that they will sometimes purchase a net lease property only to find that the home does not meet their investment criteria. Before committing to a lease purchase, the investor must consider all of their options. The best way to do this is to consult with an attorney familiar with this type of transaction. An attorney can help you understand whether or not the net lease agreement would benefit your particular situation.

Another thing to keep in mind before investing in triple net lease properties for sale is that the lease typically has an exit clause. Many investors find that this clause is something of a double-edged sword. On the one hand, it gives the investor the right to sell the property should they wish to; however, it also allows the lessee ( purchaser ) to stay in the home should they choose not to. Because this exit clause is very important to investors, it is always best to consult with an attorney before signing the lease agreement. It is important to remember that investors who purchase net lease properties often receive some benefit. This benefit could be in the form of appreciation. Gaining this appreciation can significantly change the cost/value of the property. The most common benefit of net lease agreements is the ability to purchase the property for less than what they paid, should they choose to do so at any point during the lease. Investors who purchase these types of leases have often chosen to stay in the house long-term, which increases their investment.

|